Irc 415 B Limit 2024. Now is a good time to review your current contributions to your. Asia pacific +65 6212 1000.

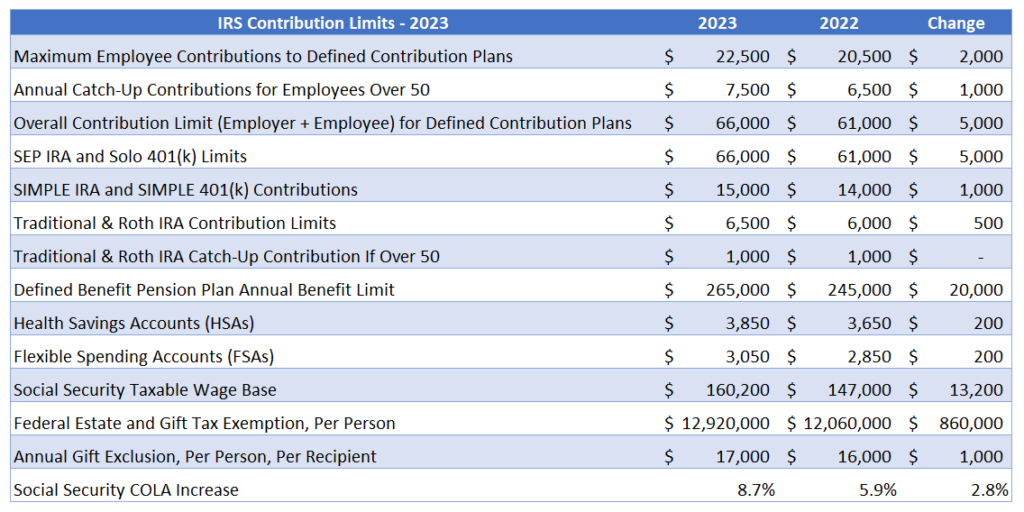

Maximum deferrals under a 401 (k) or 403 (b) plan rose from $22,500 to $23,000, while maximum benefits under a defined benefit plan rose from $265,000 to. The irc 415 (b) annual benefit limit is published by the internal revenue service (irs) f or retirees aged 62 and older, and may be periodically adjusted based on inflation.

Irc 415 B Limit 2024 Images References :

Source: earlyretirement.netlify.app

Source: earlyretirement.netlify.app

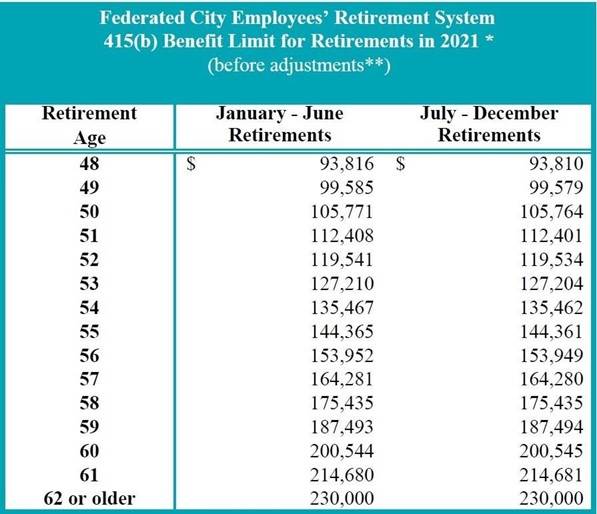

Retirement plan 415 limits Early Retirement, The chart below reflects these changes.

Source: tonyaqjessamyn.pages.dev

Source: tonyaqjessamyn.pages.dev

415 Contribution Limits 2024 Perry Brigitta, Asia pacific +65 6212 1000.

415 B Limit 2024 Sofia Eleanora, Americas +1 212 318 2000.

Source: tonyaqjessamyn.pages.dev

Source: tonyaqjessamyn.pages.dev

415 Contribution Limits 2024 Perry Brigitta, The chart below reflects these changes.

Source: www.pensiondeductions.com

Source: www.pensiondeductions.com

Defined Benefit IRC 415(b) Limit Explained PD, Irc section 415 requires a 403 (b) plan participant, who is also participating in a defined contribution plan of an employer, that the participant controls, to aggregate.

Source: aleneqjenifer.pages.dev

Source: aleneqjenifer.pages.dev

Irs Tax Deferred Contribution Limits 2024 Thea Abigale, 2024 cost of living adjustments (cola) and retirement plan limits.

Source: mytaxhack.com

Source: mytaxhack.com

415 Retirement Plan Deadline What You Need to Know Tax Hack, 415 (c) defined contribution dollar limitation for a short limitation year resulting from an initial, amended, or.

Source: gennabgiovanna.pages.dev

Source: gennabgiovanna.pages.dev

2024 Irs 401k Limit Catch Up Candy Ronnie, In the case of an annuity contract described in section 403 (b), the preceding sentence shall apply only to the portion of the annuity contract which exceeds the limitation of subsection (b) or the limitation of subsection (c), whichever is appropriate.

Source: slideplayer.com

Source: slideplayer.com

Fundamentals I of Retirement Plan Issues Chapter Seven/Week Eight ppt, Maximum deferrals under a 401 (k) or 403 (b) plan rose from $22,500 to $23,000, while maximum benefits under a defined benefit plan rose from $265,000 to.

Source: www.firstdollar.com

Source: www.firstdollar.com

IRS Makes Historical Increase to 2024 HSA Contribution Limits First, This article discusses how to adjust the irc sec.